November Is Long Term Care Month

Addressing the potential threat of long-term care expenses may be one of the biggest financial challenges for individuals who are developing a retirement strategy.

The U.S. Department of Health and Human Services estimates that 70% of people over age 65 can expect to need long-term care services at some point in their lives.1 So understanding the various types of long-term care services – and what those services may cost – is critical as you consider your retirement approach.

WHAT IS LONG-TERM CARE?

Long-term care is not a single activity. It refers to a variety of medical and non–medical services needed by those who have a chronic illness or disability – most commonly associated with aging.

Long-term care can include everything from assistance with activities of daily living – help dressing, bathing, using the bathroom, or even driving to the store – to more intensive therapeutic and medical care requiring the services of skilled medical personnel.

Long-term care may be provided at home, at a community center, in an assisted living facility, or in a skilled nursing home. And long-term care is not exclusively for the elderly; it is possible to need long-term care at any age.

WHAT IS LONG-TERM CARE?

Long-term care is not a single activity. It refers to a variety of medical and non–medical services needed by those who have a chronic illness or disability – most commonly associated with aging.

Long-term care can include everything from assistance with activities of daily living – help dressing, bathing, using the bathroom, or even driving to the store – to more intensive therapeutic and medical care requiring the services of skilled medical personnel.

Long-term care may be provided at home, at a community center, in an assisted living facility, or in a skilled nursing home. And long-term care is not exclusively for the elderly; it is possible to need long-term care at any age.

HOW MUCH DOES LONG-TERM CARE COST?

Long-term care costs vary state by state and region by region. The 2018 national average for care in a skilled care facility (single occupancy in a nursing home) is $100,380 a year. The national average for care in an assisted living center (single occupancy) is $48,000 a year. Home health aides cost a median $22 per hour, but that rate may increase when a licensed nurse is required.2

WHAT ARE THE PAYMENT OPTIONS?

Often, long-term care is provided by family and friends. Providing care can be a burden, however, and the need for assistance tends to increase with age.1

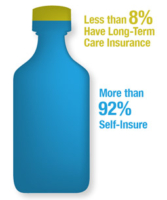

Individuals who would rather not burden their family and friends have two main options for covering the cost of long-term care: they can choose to self-insure or they can purchase long-term care insurance.

Many self-insure by default – simply because they haven’t made other arrangements. Those who self-insure may depend on personal savings and investments to fund any long-term care needs. The other approach is to consider purchasing long-term care insurance, which can cover all levels of care, from skilled care to custodial care to in-home assistance.

When it comes to addressing your long-term care needs, many look to select a strategy that may help them protect assets, preserve dignity, and maintain independence. If those concepts are important to you, consider your approach for long-term care.

Source: National Alliance for Caregiving in collaboration with AARP, 2015 (most recent data available)

FedSavvy Educational Solutions takes no responsibility for the current accuracy of this information. Securities offered through J.W. Cole Financial, Inc. (JWC) Member FINRA/SIPC. Advisory Services offered through J.W. Cole Advisors (JWCA). FedSavvy and JWC/JWCA are unaffiliated entities. Securities are not FDIC insured or guaranteed and may lose value. Investments are not guaranteed and you can lose money. This presentation is for educational purposes only and is not an offer to buy or sell an investment. Neither FedSavvy nor JWC/JWCA are tax or legal advisors and this information should not be considered tax or legal advice. Consult with a tax and/or legal advisor for such issues.