What Is the Purpose of the I Fund and How Much Should You Invest in it?

By Carol Schmidlin

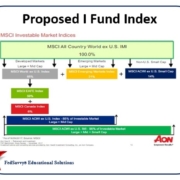

The objective of the I Fund is to match the performance of the MSCI EAFE (Europe, Australasia, Far East) Index. The earnings consist of gains (or losses) in the price of stocks, dividend income, and change in the relative value of currencies.

This was proposed in 2017 and put on hold for several years. TSP is now considering this again. As you can see the MSCI EAFE is limited and is not a true representation of the international index. This is scheduled to go into effect this year!

If you are not sure how much to contribute you can either choose a lifecycle fund the coincides with your retirement date. I also highly encourage you to visit www.MyTSPVision.com and do a risk analysis. This is a great website run by Brad Kasper.

Also, please feel free to contact me at 856-401-1101 or email me at carol@franklinplanning.com.

Source: www.TSP.gov